In recent months, unexplained shifts in the SSA Death Master File (DMF) have raised new concerns about accuracy and reliability. For administrators safeguarding participant benefits, and for insurers ensuring claims integrity, staying ahead of these changes is essential.

In a 30-minute webinar we shared exclusive insights into what we’ve been tracking in the DMF, and how we built CertiDeath®, the only validated death audit solution, to help pension funds and insurance carriers maintain accuracy, prevent overpayments, detect fraud, and save time no matter how the landscape shifts.

In this webinar, viewers learned:

- What’s driving the recent instability of the DMF

- How gaps and delays in the file put funds at risk

- Why CertiDeath’s validated results raise the bar for plan oversight

- Real-world examples of plans protecting assets and saving time

Webinar Transcript

Jeff Anderson

Thank you for joining us all today. So today, we’re going to talk through Death Master File challenges and how we’ve helped our clients with those. My name is Jeff Anderson. I’m a Senior New Business Development Manager with our team here and very delighted to be part of the organization, just celebrated my fifth year here and I have a history of data and analytics with other leaders in their marketplace and very happy to be working for the leader in the death audit space today with me. I’ve got Mike Irey who is our Director of Operations and I’m going to let Mike introduce himself and get the conversation started here.

Mike Irey

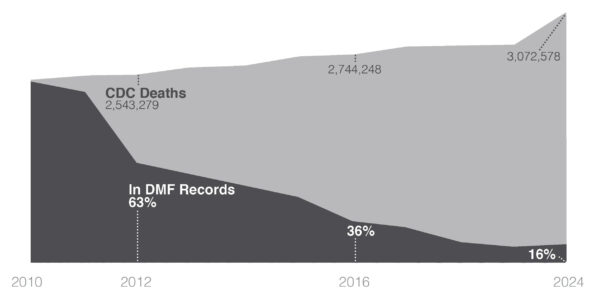

Thanks, Jeff. Appreciate it. As Jeff said, my name is Mike Irey, Director of Operations for The Berwyn Group. I’ve been in this position for about 6 years now. Before that, about seven years with our parent company, Longevity Holdings in various different aspects of the business. As Director of Operations, that means my team is the one that reviews all of the obituary, SSA and state hits that come into our queues on a daily basis and makes the validations or rejections for that. So I’m very well in tuned with how that process works for our company and for our clients. So first, we’ll start off with the DMF erosion. I know this is a little bit of a hot button topic from this year, but as you can see in this chart, the history of the DMF was it was a full Social Security death master file that provided. Close to 100% of known deaths. This was the case up to around October 2011.

That’s when issues with privacy laws coming from the states started coming up, and thus changes to the access to deaths for the full Social Security Death Master File was starting to become limited. And thus became the now Limited Access Death Master File. As you can see, it wasn’t immediate, but it was a gradual decrease in the number of deaths that show up in this Death Master File. You can see some of the markers there in 2012 or 63% and slowly just decreasing to in 2024 only 16% of deaths that we see can be attributed to the Death Master File state agencies no longer reporting. But it is usually funeral homes, family members, banks or financial institutions that might make reports. And so, while it’s a healthful piece of the puzzle, it is if you are relying solely on the DMF, we believe you’re missing close to 85% of known deaths just due to how much is increased decreased over the years and the limited access to other forms of validations that come from it.

So, some of the hot button topics that have come up specifically this year and some of the changes to the Limited Death Master File, both of these occurred in two things occurred in April of this year. The Death Master File added over 10 million lives to their file. It was for everyone that was 120 years or older, so think of it 1900 dates of birth, 1905 or earlier. So, obviously all of these people are deceased, so the impact wasn’t great. It was more of a cleaning up of records. What we saw, we didn’t see that many deaths for any of our Clients simply because you know most of those had cleaned up that data and knew that anyone that age was deceased. But it did allow us to clean up some of that data. It also allowed us to see where some data regularities could be occurring with our clients, either with their Social Security numbers or with other parts of their data. That would, you know, that would maybe not have been validated had we not had a human or somebody else look at it because the algorithms that match just on SNN wouldn’t have picked that up. Also, what happened towards the end of April was they added about 6,000 living individuals. This was to cut off benefits for those people. We were able to see that come in. It didn’t have any impact on any of the lives that we were monitoring, but we also saw that the way that file came in made it clear that that was not a normal file for that week. And thus, we flagged it and we’re able to prevent it from causing any issues with any of our clients files. This of course got reversed. Got a couple months later in June, and those people were removed, although we didn’t see that everyone was removed, although with the way that we flagged it in our system and helped prevent any issues to any of our clients, any you know, incorrect validations to our clients data because we were able to see it ahead of time and kind of cut it off. In September of 2025, again, this is right around Labor Day, another million people were added to the file. This didn’t have anything to do with people that were over 120 years old or living people. This was just another million lives added. We had less than 1,000 into our system that could have matched actually well less than 1,000. Not all of them were valid. Some of those would have been false positives had we not had somebody double check the data integrity with the SSNs again could be somewhat compromised. Some were valid and able to be accepted. The vast majority wants over 95% of these were with dates of death before 2010. Going back all the way to 1960s again, not many that would have affected some of our club. But what we saw with some of the data integrity issues with SSNs, names, dates of birth, things of that nature, we’re able to review it and reject any that were not clear matches and only accept the ones that were. So, we really made sure that nothing got through that would cause issues for any of our clients. For all of these, there was no warning or advance notice of any kind before this happened. We monitor this on a weekly basis. So Sunday, Saturday or Sunday sometime over the weekend. When the DMF comes to our queue we are able to flag it for any irregularities. These obviously stood out and by Monday morning we had an understanding as far as what the impact was going to be. For our clients, we did even further analysis throughout the week as far as why these came in and what, what that means for everyone. I don’t know what’s going to happen in the future. I wish I did so we could be more prepared, but we do have a system in place to monitor anytime irregularities like this show up from the DMF. To flag that immediately and work on it internally to avoid any false positives as well as no fire clients if there’s any issues that could be coming their way. Because of the decline of the Limited Death Master File and because of some of the irregularities that are coming because with the DMF we take a more holistic approach and look for many different sources. As you can see in the left hand side we use the limited death master and we have access directly to state sources. These can be difficult to obtain and take a while to get access to them and they produce records unlike the DMF that does it every week. State records can come either weekly, monthly, quarterly or even more irregular than that either, semi-annual or annually. But it is a source that we have, but the majority of these of the deaths we find are from obituaries. And the chart there, it shows 67% on our regular weekly file. It’s actually a higher percentage, probably closer than the 80% range. And part of that is because obituaries just get published faster. The DMF as I mentioned can be semiannual, quarterly, monthly. So, obituaries are published typically within a week, maybe 2 at most of the death for the most part and we see it where if somebody’s obituaries published on Monday, we’ll find out about it on a Tuesday and that gets reported out to our clients that week. So, this speed on which they can get published allows us to have greater coverage. That said, obituaries are tricky where the DMF or state records rely on an SSN, name and date of birth. Obituaries don’t have that SSN standard, so you are stuck with name, dates of, you know, dates of birth locations. And, there’s no editorial standards. We’ve actually seen the writing of obituaries shift a little bit in those last year. There are a little bit more complicated just with the way it is written. Not sure why that is. But it has made it a little bit more challenging to understand what is actually being said within obituary. As far as relationships and locations, some of them are we know people with. Whenever an obituary is published, typically they are published with somebody’s original birth first name. That’s not always how people go by names in real life. So, we’ve seen clients on file with the middle name that they always used that was where a first name would end up, which it turns out is actually the middle name in the obituary. You know, obituary locations can be published, typically around where that person had lived at most recently, but it’s it can be published in hometowns, it can be published where they lived with family locations that aren’t quite clear. If you think that you have a recent location on file. We also know most of our clients locations, about 30% of them are out of date. So, we are constantly updating locations to make sure that we are finding the right people in the right spots, ages and dates of birth are not always listed in obituaries or, as I had mentioned, sometimes they’re not written clearly, so it’s difficult to decipher that. So all of these aspects of it bring in some fuzziness to that approach, and one of the things that we pride ourselves on here is having a system, process and people that are skilled enough to understand how to review these. We have detailed processes that we’ve been working on for going back to 10 years. And we did this internally just for ourselves before we rolled it out to the market. That has been back tested over millions and millions of obituaries to ensure that we have the highest quality validation. And, you know, reduce any potential false positives or any missed deaths. We have people that understand what that process is with the QC process as well to ensure that nothing gets missed. We continue looking for ways to get better, whether that’s a new approach to with twins. As you can imagine, everyone likes to name twins with rhyming names and that can get rather difficult. So, we have done a great job in limiting any potential false positives due to that as well as utilizing our data vendors to get updated information, whether that’s names, dates of birth, locations, relatives to help fill in any gaps that might be necessary to be comfortable enough to make a validated open. And this goes back a year or two ago, we’ve added in keywords for all our clients to help us. If you know somebody for just for example, they work for Coca-Cola and that was one of our clients, we would make sure that keywords such as Coca-Cola or you know factory work or anything Along those lines would be in our notes to ensure that if that is written in an obituary, we would find it the same as if they were a teacher or fireman or any other profession that they’ve ever had. We have that highlighted so that we can ensure that we don’t miss anything when again other data points might be missing such as age or locations might be off. So, we take a very comprehensive approach with as much data as we can possibly pull in to ensure that we are making validations and as it says here, you can have multiple obituaries and sometimes you have to look at multiple different obituaries to kind of piece in that puzzle, not just one. Obituaries are OK with it, so we take a comprehensive approach through our process and using our system that people have been trained on for years to ensure we don’t make any mistakes and there’s complete and comprehensive in our validations as possible. Back to Jeff.

Jeff Anderson

Mike, as we jump back over and talk about that solution and more with how we do and you are getting into some of the details of the validation there, a couple things. One, we use the word obituary a lot I hear from clients frequently. Well, there’s not as many people doing paid obituaries these days, but when we say obituary, we’re referring to the paid obituaries, but also the Funeral Home notices, the free tributes, our proprietary obituary databases, vast with information that certainly goes far beyond the paid obituaries today. And then I thought you made a great point too about the false positives because the comprehensive approach to identifying as many deaths as possible is critical, and that’s important. That’s why we keep doing what we’re doing and growing our database and the technology process. And then your team with the validations. But what’s really important about that as well is getting that right and the accuracy matters. And that’s where we’ll jump in and talk a little bit more here about the CertiDeath solution. So, as Mike mentioned, CertiDeath and the solution that we have developed over a long runway. CertiDeath was introduced to our clients really in its full form and put into use by many clients in 2019. S,o we’re more than six years now of runway information and providing great results. Mike’s team learns in that process right and we continue to get better as we go and we’ve got a lot of years under our belt of making those validations. So, the way that the CertiDeath solution works is based around the database that we have, the technology that we continue to refine and develop. And the team of experts that, that Mike works with and ensures that not only are we getting a comprehensive data set, but one that is extremely accurate. Through studying our own results that we are capturing 96.5% of all the deaths that occur in the United States. Where that starts is with our database and what’s really important to know is that our database – we are data independent. We’re making sure that our clients know that we’re going to have continue to have access to that database. So, we have heard stories from other clients where they’ve been in a situation where they were getting a good data set and then all of a sudden they’re not seeing the data come through the way it was coming through anymore and oftentimes, if you ask enough questions, what you’ll end up finding out is that’s got to do with their contract on the back end and how they’re getting their data. So very important to understand that we own our database and we are data independent. So you would not see that downward trajectory with the data that we have coming in. Unless we have something weird happening with the DMF without notice, but as far as our obituaries and the and the state records, we’re very consistent. The technology, again the refinement, it’s a sophisticated system that what’s really important about it is it’s flagging the right level of information for the expert team to go in and utilize that proprietary process to triangulate the information on the file. The information that’s coming in to us, whether that’s the obituary information, DMF information or state information to make sure that what we’re sending out to our clients is as accurate as it can be. So, the process chart that I jumped into a little bit, I think one important thing to know with CertiDeath, there’s really a step before step one, so the four steps you see on the screen here is the process of the actual death audit. But the first step that really happens when you’re a client of ours is you’ve got a dedicated Client Success Manager that when your file is uploaded, the data that we see on the file, well, usually it’s pretty good. Good enough for us to work with it, but in the event that there’s a challenge with the data that we see on the file, you’d hear from that Client Success Manager to ask some questions and get on the same page to make sure that we’re starting in the right spot. So once we pull that file in, we’ve got over 40,000 data sources that we’re using to compare your file against the potential death matches, right? And then, that step 2 is the matching process that’s going to take place using our proprietary system. The third step is what we’ve talked a lot about today, which is the Mike’s team doing the work to look at the scored matches and determine whether this has the right level of data for us to send this through as a match for our clients or if it’s something that we need to. Escalate in the process to take further steps to validate or whether it’s a rejection and then the final step in the process is our clients receive a report. Our standard reporting with CertiDeath is on Thursday overnight and in that report you’re going to see dates of death along with the source documentation, so that may be coded as SA for the DMF records. It may be coded as STA if it was a state record and as you saw nearly 70% of our results come from the obituary information that’s available that has been validated. Put in your report a date of death and a link to that obituary. Not linked to the obituary can be very helpful or the next steps that you may have in the process. So, as you’ll see on the next slide…

Mike Irey

One thing on this slide, go back to that the matching. The matching isn’t. We don’t do simple matching. We do sophisticated matching where we have fuzzy logic for names, locations, dates. It’s very sophisticated to ensure that we have a complete view of all the matches. We don’t want something to not come through as a match just because somebody misspells a name or has a date of birth that’s, you know, a placeholder or seen with the locations. We try to make it as broad as possible so that we can act. We can supplement the data that the client provided to us with additional data to maybe update it to make a better match. So, we take a broad approach to making matches and then can narrow down and get more specific once we get the updated data. And then as far as results, if you’ve ever seen our results and maybe question well, how did they validate something be the data we provide is the data you provide to us for the participant as well as the initial data. What might not be seen in the Excel file, but that would be apparent in the obit URL link or the obit is any additional data we might update from the obituary, you know, maybe a location is blank and we add that in maybe a date of birth is blank. We add that in names are misspelled, those sorts of things. That might not be apparent right away in the report, but it is something that we do on our side to ensure that we’re making matches as clear and concise and verified matches as possible. So just want to make sure that that part was clear on the results side.

Jeff Anderson

That’s perfect, though those are great points and one wonderful thing that I hear from clients when I go back and talk to those that that I work through the process with, we got them on board and then they go to our client success team. And when I follow up later, one of the things that I often hear is, oh, we had a lot of questions early on and the dedicated Client Success Manager that we had was able to answer most of those questions, but there were some that took, you know, a little bit more time because they were more challenging and typically what that is somebody that Client Success Manager going directly. I’m looking at the information with his team to make sure that we’ve got the right answer coming back to that client, so that’s excellent. All right. So, on the next slide really is the impact CertiDeath. In the death audit space, it can be very rewarding sometimes to hear back from our clients on the stories that they share with us and the impact that we make. Now, in many cases we can’t share those directly or attribute those, but we do work hard to try and share those stories and make sure that other clients are aware of the impact that they should at least be considering or thinking about with their business. So, from a pension fund standpoint and defined benefit pension fund payments are going out on a monthly basis. If those aren’t stopped timely, that can be consequential, and if they go on for too long as the data gets older, they can be more challenging to solve for. And those overpayments can be a huge impact. I work with a number of clients, but one in particular just commented to me that in our original estimate to them through our free file analysis process we had estimated a little over $1,000,000 in overpayments that we were going to identify and that it’s more like 4. So, the impact can be absolutely great with what we’re doing here from a defined benefit standpoint, but also the non-pay participants and the impact on funding to the plan as well as other actuarial. Assumptions and things that go into making sure that you’ve got good data within your population management. I mentioned we do provide the link to the to the obituary. We’ve heard from clients that can be extremely helpful with providing them clues and who they need to reach out to as far as taking the next step. And as I mentioned, we’ve got more stories, we’ve got a link for you there with impact stories. And then we also continue to keep up on our blog with developments as the DMF changes happen and other things that our audience should be aware of. Mike, anything else to say?

Mike Irey

Nothing other than I would say, we take a lot of pride in being as comprehensive and as accurate as possible. Any of our current clients I ask them to provide feedback for anyone who might have gotten incorrect or any deaths, they find that we didn’t as it only makes our process better. So, we have a lot of passionate people here that recognize the value that we provide to our clients and not just to our clients, but to the participants. So, we’re here to help. We’re here to make your lives better.

Jeff Anderson

Undoubtedly, the years of feedback that we have that we provide to you and your team, it makes the solution better for us to talk about the salesperson, but it makes it the end result better for our clients and that’s the most important thing here. With that, I do not see any questions in the queue. I think we we’ve covered our time here. We really appreciate everyone spending their afternoon with us and we hope that you have a great. Thank you!